Charlie Kirk in the depths of the COVID-19 market sell-off allegedly bought a ton of leveraged Nasdaq shares ($TQQQ) on the stock market during its crash. People around him at the time laughed at him because it was March of 2020 and obviously the worst was yet to come. Most of the people around him were betting against the market and his response was, “You’re going to bet against America?! Really?” He was early but he was right.

Like a lot of Americans, Charlie has been on my mind for a lot of the past month. I refuse to move on to the new current thing as there is something deeply unsettling about his assassination. For older Americans, seeing leaders get shot at and assassinated for their speech isn’t the most far-fetched thing but for a Millennial like myself, the past year is the first in living memory where these types of events are center stage. This post isn’t about the politics of all of this but I will say, if your side is the one being shot at for their speech, history is typically in your favor.

In today’s day and age, simply believing in the American dream is a superpower. Refusing to fall victim to the extremes on either side and simply betting with America is not only weirdly contrarian nowadays but it is also trend following when you zoom out. Following trends in markets are how fortunes are built. Contrarian & trend-following is a rare combination that produces good results as the two don’t typically match up. I like to imagine explaining what the current American sentiment is like to my Great-Grandfather and seeing his reaction. Back then it was contrarian to be anti-American and the pro-American consensus was aligned with the trend. People said we were the greatest country on earth and believed in it. Sadly nowadays this isn’t the case.

This isn’t to say I don’t get why sentiment towards our great nation is negative. I get it. My introduction to the workforce as an adult was in 2009 at the depths of the Great Recession. I joined the military in 2010 with guys who had Master’s degrees and waited for years just to enlist. I graduated college with student loan debt even with having the GI Bill and having spent my first 2 years in Community College getting my Associates before finally going to a “real” college. The promise that was once the America dream has re-written the rules and most of us still haven’t received the message. People under 35 are still trying to play by the same rules as their Baby Boomer era parents without realizing our predicament is much more aligned with the Silent Generation - the traditionalists. With the consequences of pervasive globalization and Fed-fueled and under reported inflation, you cannot run the same playbook as the hippie Boomers and expect to get ahead.

How you get ahead in this trying era of the shining city on the hill, is abandoning comfort to join The Shareholder Class. How to get enough money to join the shareholder class is by working a few jobs, living off of PB&J and not spending any money on the weekends while ridding yourself of high-interest debt. Does it suck? Sure. But it will change your life forever if you save & simply align your outcomes with America. Stop shorting the greatest country on earth by simply not owning a share.

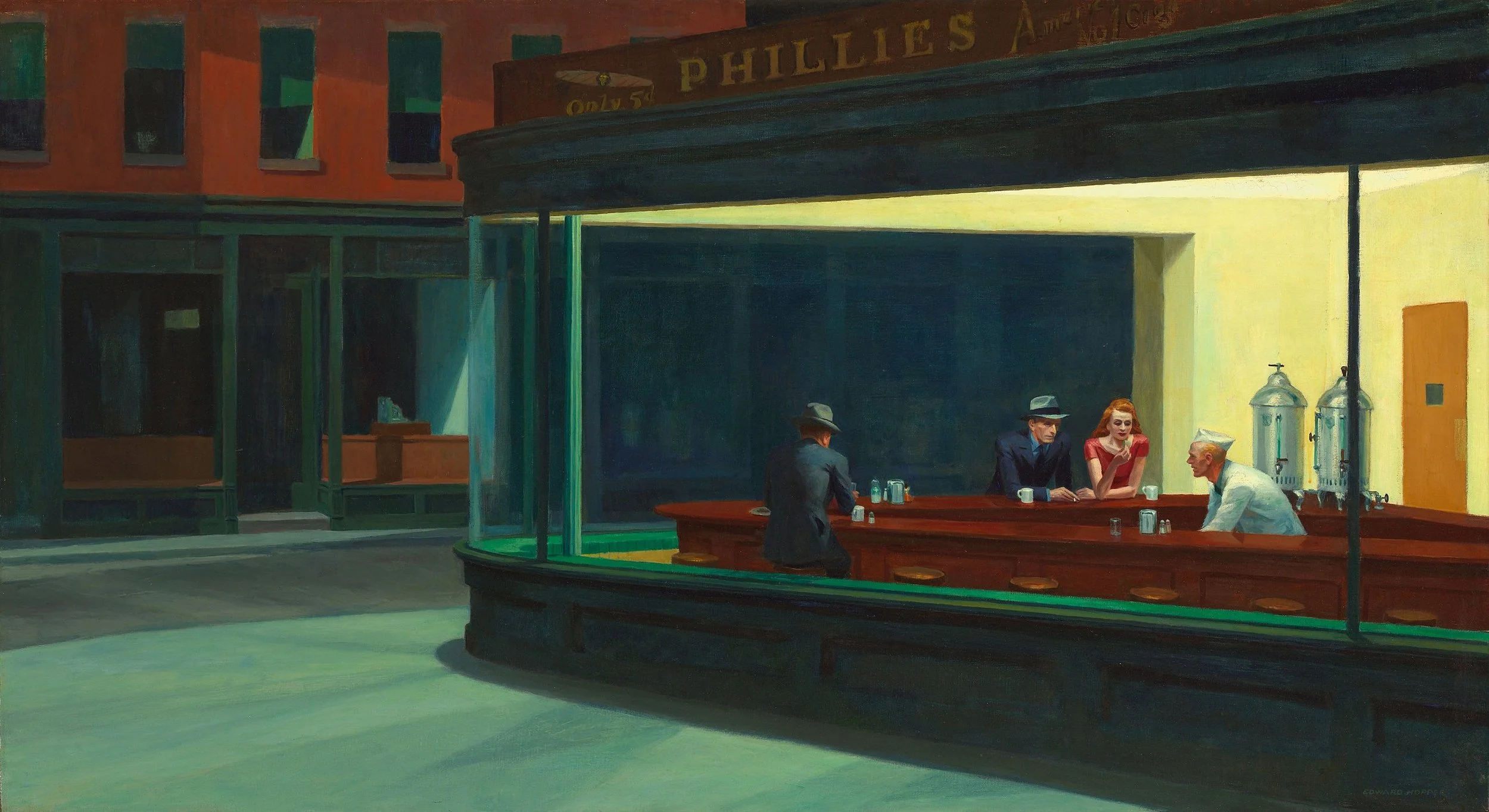

The youth would be wise to remember the forgotten stories of our grandparents or great-grandparents. The ones who would steal the sugar packets at diners to take home. The ones who dumped all their savings into war-bonds so we could win multiple world wars. As a generation, they embraced minimalism, self-reliance, and ownership. Same with the pioneering generations who came before them. They believed in God and knew that being an American meant you had to go out on the frontier. Younger Americans would be wise to remember we come from a nation of rebels who loathe all forms of government. We do not beg them to pay off our student loans.

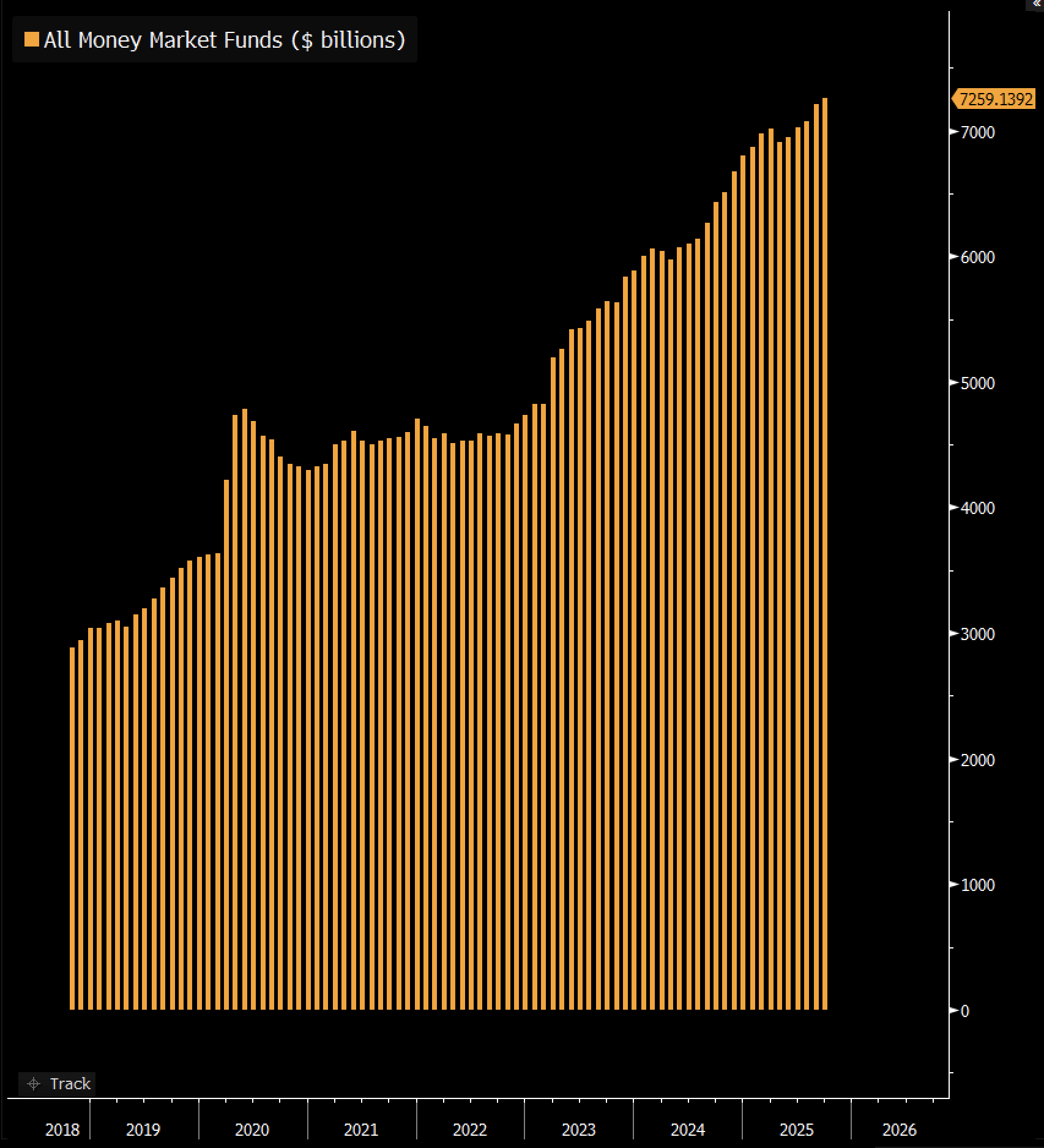

Money Market holdings are at an all-time high due to media-fueled fear. This is all fuel for higher prices into 2026.

If not here, then where? There is no alternative. No nation has the founding principals of ours. Stop glamorizing the hunt for another big short and betting against America. Holding cash on the sidelines and voluntarily losing to inflation is for risk-adverse Europoors not Americans. Long the Republic.

Rest in peace, Charlie.